PROXY STATEMENT

FOR 20212023 ANNUAL MEETING OF STOCKHOLDERS

To Be Heldbe held at 8:30 a.m. Pacific Time on Thursday, June 3, 20211, 2023

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our boardBoard of directorsDirectors ("Board") for use at the 20212023 annual meeting of stockholders of Sunrun Inc., a Delaware corporation (“Sunrun” or the “Company”), and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Thursday, June 3, 20211, 2023 at 8:30 a.m. Pacific Time, via a live audioaudio-only webcast. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed or available to stockholders on or about April 21, 202119, 2023 to all stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What matters am I voting on?

You will be voting on the following proposals:

•the election of three Class IIIII directors as named in this proxy statement to serve until our 20242026 annual meeting of stockholders;

•the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021;2023;

•the advisory approval of the compensation of our named executive officers (“Say-on-Pay”), as disclosed in the proxy statement;

•a stockholder proposal relatingthe amendment to a public report on our Amended and Restated Certificate of Incorporation to declassify our Board of Directors (the “Declassification Amendment”);

•the useamendment to our Amended and Restated Certificate of mandatory arbitration;Incorporation to eliminate supermajority voting requirements (the “Majority Voting Standard”); and

•any other business as may properly come before the Annual Meeting.

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting.

How does the board of directorsBoard recommend I vote on these proposals?

Our board of directorsBoard recommends a vote:

•“FOR” the election of Katherine August-deWilde, Sonita Lontoh,Leslie Dach, Edward Fenster, and Gerald RiskMary Powell as Class IIIII directors;

•“FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021;2023;

•“FOR” the advisory approval of the compensation of our named executive officers (“Say-on-Pay”), as disclosed in the proxy statement;

•“FOR” the Declassification Amendment; and

•“AGAINST”FOR” the stockholder proposal relating to a public report on the use of mandatory arbitration.Majority Voting Standard.

Who is entitled to vote?

Holders of our common stock as of the close of business on April 8, 2021,6, 2023, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting.

Registered Stockholders. If on April 8, 2021,6, 2023, shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote in person during the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If on April 8, 2021,6, 2023, shares of our common stock are held on your behalf in a stock brokerage account, or by a bank, trustee or other nominee, you are considered the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares and are also invited to attend the Annual Meeting. Please follow the instructions provided by your broker, bank or other nominee as to how to vote your shares. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank, trustee or other nominee as “street name stockholders.”

What constitutes a quorum for the Annual Meeting?

A quorum is required for stockholders to conduct business at the Annual Meeting. The presence, in person or represented by proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to establish a quorum at the meeting. As of the close of business on the record date, there were 203,799,327215,472,156 shares of our common stock outstanding. Shares present, in person or represented by proxy, including shares as to which authority to vote on any proposal is withheld, shares abstaining as to any proposal and broker non-votes (where a broker submits a properly executed proxy but does not have authority to vote a stockholder’s shares) on any proposal will be considered present at the meeting for purposes of establishing a quorum.

How many votes do I have?

In deciding all matters at the Annual Meeting, each stockholder will be entitled to one vote for each share of our common stock held by them on the record date. Stockholders are not permitted to cumulate votes with respect to the election of directors.

How many votes are needed to approve each proposal?

•Proposal No. 1: The election of directors requires a plurality vote of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as directors. Any shares not voted “FOR” a particular nominee (as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “FOR” or “WITHHELD” on each of the nominees.

•Proposal No. 2: The ratification of the appointment of Ernst & Young LLP requires the affirmative vote of a majority of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to

vote. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “AGAINST.” Broker non-votes will have no effect on the outcome of this proposal.

•Proposal No. 3: The approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of a majority of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote. As described in Proposal No. 2 above, an abstention will have the same effect as a vote “AGAINST” and broker non-votes will have no effect.

•Proposal No. 4: 4: The approval of the stockholder proposal relating to a public report on the use of mandatory arbitrationDeclassification Amendment requires the affirmative vote of a majorityholders of at least sixty-six and two-thirds percent (66 ⅔%) of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meetingoutstanding and entitled to vote. As described in Proposal No. 2 above, an abstentionAbstentions and broker non-votes will have the same effect as a vote “AGAINST”“AGAINST.”

•Proposal No. 5: The approval of the Majority Voting Standard requires the affirmative vote of holders of at least sixty-six and two-thirds percent (66 ⅔%) of the voting power of the shares outstanding and entitled to vote. Abstentions and broker non-votes will have no effect.the same effect as a vote “AGAINST.”

How do I vote?

If you are a stockholder of record, there are threefour ways to vote:

• By Internet: You may submit a proxy over the Internet by following the instructions at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time the day before the Annual Meeting (have your Notice or proxy card in hand when you visit the website);

• By Toll-free Telephone: You may submit a proxy by calling (800) 690-6903 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time the day before the Annual Meeting (have your Notice or proxy card in hand when you call); or

• By Mail: You may complete, sign and mail your proxy card (if you received printed proxy materials) which must be received by us no later than the day before the Annual Meeting; or

• By Completing an Online Ballot at the Annual Meeting: You may attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/RUN2023 and complete an online ballot at the Annual Meeting. Please have your 16-digit control number previously provided to you in your proxy materials and the meeting password.

Even if you plan to attend the Annual Meeting virtually via the Internet, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank, trustee or other nominee in order to instruct your broker or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning an instruction card, by telephone or by Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares during the Annual Meeting unless you obtain a legal proxy from your broker, bank, trustee or other nominee.

Assistance and Additional Information

If you need assistance with submitting a proxy to vote your shares via the Internet, by telephone or by completing your Sunrun proxy card, or have questions regarding the virtual annual meeting, please contact MacKenzie Partners, the proxy solicitor for Sunrun, at (800) 322-2885 (toll-free for stockholders), (212) 929-5500 (collect for banks and brokers) or proxy@mackenziepartners.com.

Can I change my vote after submitting my proxy?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting in any one of the following ways:

• You may enter a new vote by Internet or by telephone until 11:59 p.m. Eastern Time the day before the Annual Meeting;

• You may submit another properly completed proxy card by mail with a later date, which must be received by us no later than the day before the Annual Meeting;

• You may send written notice that you are revoking your proxy to our Corporate Secretary at Sunrun Inc., 225 Bush Street, Suite 1400, San Francisco, CA 94104, which must be received by us no later than the day before the Annual Meeting; or

• You may attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/RUN2021RUN2023 and complete an online ballot at the Annual Meeting. Please have your 16-digit control number previously provided to you in your proxy materials and the meeting password. If you are a street name stockholder, your broker or nominee can provide you with instructions on how to change your vote.

What do I need to do to attend the virtual Annual Meeting?

Access to the virtual meeting will begin at 8:15 a.m. Pacific Time on Thursday, June 3, 2021.1, 2023.

Registered Stockholders. If on April 8, 2021,6, 2023, shares of Sunrun common stock were registered directly with your name with AST, our transfer agent, you can attend the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/RUN2021RUN2023 and entering the 16-digit control number previously provided to you in your proxy materials.

Street Name Stockholders. If on April 8, 2021,6, 2023, shares of Sunrun common stock were held on your behalf in a stock brokerage account, or by a bank, trustee or other nominee, you can attend the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/RUN2021RUN2023 and entering the 16-digit control number previously provided to you in your proxy materials. Street name stockholders who did not receive a 16-digit control number from their bank or brokerage firm, who wish to attend the meeting, should follow the instructions from their bank or brokerage firm, including any requirement to obtain a legal proxy. Most brokerage firms or banks allow a shareholderstockholder to obtain a legal proxy either online or by mail.

The virtual Annual Meeting website will be active fifteen minutes prior to the start of the meeting and stockholders are encouraged to log in to the meeting early. Only stockholders who have a 16-digit control number may attend the meeting and vote during the meeting. Stockholders experiencing technical difficulties accessing the meeting may call the support number which appears on the login page.

Why are you holding a virtual Annual Meeting?

We have adopted a virtual meeting format for our Annual Meeting to provide a consistent experience to all stockholders regardless of geographic location. We believe this is an important step both to enhance stockholder access and engagement and to reduce the environmental impact of our Annual Meeting. Moving to a virtual meeting format is particularly important this year to protect our stockholders and employees in light of the evolving public health and safety considerations posed by the ongoing coronavirus (COVID-19) pandemic.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors.Board. Our board of directorsBoard has designated Lynn Jurich, Ed Fenster, Tom vonReichbauerMary Powell, Danny Abajian, and Jeanna Steele as proxy holders. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directorsBoard as described under “How“How does the board of directorsBoard recommend I vote on these proposals?” above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned to a later date, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions before the new date, as described above.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 21, 2021 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mailemail by following the instructions contained in the Notice. We encourage stockholders to take

advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting and who will bear the cost of this solicitation?

Our board of directorsBoard is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

How may my brokerage firm or other nominee vote my shares if I fail to provide timely directions?

Brokerage firms and other nominees, for example, banks or agents, holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on Proposal No. 2, our sole “routine” matter, but brokers and nominees cannot use their discretion to vote “uninstructed” shares with respect to matters that are considered “non-routine”.“non-routine.” “Non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, election of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation) and certain corporate governance proposals, even if management supported. Accordingly, your broker or nominee may not vote your shares on Proposals Nos. 1, 3, 4 or 45 without your instructions, but may vote your shares on Proposal No. 2.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8‑K (“Form 8-K”) that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8‑K within four business days after the Annual Meeting, we will file a Form 8‑K to publish preliminary results and will provide the final results in an amendment to the Form 8‑K as soon as they become available.

What is the deadline for stockholders to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 20222024 annual meeting of stockholders, the proposal must be mailed to us and our Corporate Secretary must receive the written proposal at our principal executive offices not later than close of business (5:00 p.m. Pacific time)Time) on December 22, 2021.21, 2023. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to: Sunrun Inc., Attention: Corporate Secretary, 225 Bush Street, Suite 1400, San Francisco, CA 94104.

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before such meeting by or at the direction of our board of directors,Board, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for our 20222024 annual meeting of stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

• not earlier than February 5, 2022;4, 2024; and

• not later than the close of business on March 7, 2022.5, 2024.

In the event that we hold our 20222024 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before our 20222024 annual meeting of stockholders and no later than the close of business on the later of the following two dates:

• the 90th day prior to our 20222024 annual meeting of stockholders; or

• the 10th day following the day on which public announcement of the date of our 20222024 annual meeting of stockholders is first made.

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Sunrun will not consider any proposal or nomination that is not timely or otherwise does not meet the requirements of our Bylawsbylaws and SEC regulations. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Nomination of Director Candidates

You may propose director candidates for consideration by our nominating, governance, and corporate governancesustainability committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directorsBoard and should be directed to our Corporate Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors.”

In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Universal Proxy

In addition to satisfying the foregoing requirements under our amended and restated bylaws, to comply with the universal proxy rules (once effective), stockholders who intend to solicit proxies in support of director nominees other than our board’s nominees must provide notice that sets forth any additional information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) no later than April 2, 2024.

Availability of Bylaws

A copy of our amended and restated bylaws is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Corporate Governance” section. You may also contact our Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our boardBoard of directors,Directors ("Board"), which is currently composed of nine members. Six of our directors are independent within the meaning of the listing standards of The Nasdaq Stock Market (“Nasdaq”). Our board of directorsBoard is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring.

Proposal 4 in this Proxy Statement is a proposal and recommendation of our Board to adopt a certificate of amendment to our Amended and Restated Certificate of Incorporation (the “Restated Certificate”) to phase out the classification of our Board over a three-year period such that, if approved, beginning at the election of directors at the 2026 annual meeting of stockholders, all directors would be annually elected for a one-year terms (the “Declassification Amendment”). The affirmative vote of holders of at least sixty-six and two-thirds percent (66 ⅔%) of the voting power of the shares outstanding and entitled to vote will be required to approve the Declassification Amendment. If the Declassification Amendment is not approved by our stockholders, our Board will remain classified.

The following table sets forth the names, ages as of April 21, 2021,6, 2023, and certain other information for each of the directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting), each new director nominee, and for each of the continuing members of our board of directors. Ms. Ellen Smith will not stand for reelection when her current term expires on the date of the Annual Meeting. Ms. Sonita Lontoh is a new director nominee and was recommended by a third-party search firm.Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class | | Age | | Position | | Director

Since | | Current

Term

Expires | | Expiration

of Term

For Which

Nominated |

| Directors with Terms Expiring at the Annual Meeting/Nominees | | | | | | | | | | | | |

Katherine August-deWilde (1) (2) | | III | | 73 | | Director | | 2016 | | 2021 | | 2024 |

| Sonita Lontoh | | III | | 45 | | Director | | — | | — | | 2024 |

Gerald Risk (3) (4) | | III | | 52 | | Director | | 2014 | | 2021 | | 2024 |

| | | | | | | | | | | | |

| Continuing Directors | | | | | | | | | | | | |

| Lynn Jurich | | I | | 41 | | Chief Executive Officer and Director | | 2007 | | 2022 | | — |

Alan Ferber (1) (2) | | I | | 53 | | Director | | 2018 | | 2022 | | — |

| David Bywater | | I | | 51 | | Advisor and Director | | 2020 | | 2022 | | — |

| | | | | | | | | | | | |

Leslie Dach (1) (3) | | II | | 67 | | Director | | 2016 | | 2023 | | — |

| Edward Fenster | | II | | 44 | | Executive Chairman and Director | | 2007 | | 2023 | | — |

Mary Powell (2) (3) | | II | | 60 | | Director | | 2018 | | 2023 | | — |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Directors | | Class | | Age | | Position | | Director

Since | | Current

Term

Expires | | Expiration

of Term

For Which

Nominated |

| Directors with Terms Expiring at the Annual Meeting/Nominees | | | | | | | | | | | | |

Leslie Dach(1)(3) | | II | | 68 | | Director | | 2016 | | 2023 | | 2026 |

| Edward Fenster | | II | | 46 | | Co-Executive Chair and Director | | 2007 | | 2023 | | 2026 |

| Mary Powell | | II | | 62 | | Chief Executive Officer and Director | | 2018 | | 2023 | | 2026 |

| | | | | | | | | | | | |

| Continuing Directors | | | | | | | | | | | | |

Katherine August-deWilde(1)(2) | | III | | 75 | | Director | | 2016 | | 2024 | | — |

Sonita Lontoh(2)(3) | | III | | 47 | | Director | | 2021 | | 2024 | | — |

Gerald Risk(3)(4) | | III | | 54 | | Director | | 2014 | | 2024 | | — |

| Lynn Jurich | | I | | 43 | | Co-Executive Chair and Director | | 2007 | | 2025 | | — |

Alan Ferber(1)(2) | | I | | 55 | | Director | | 2018 | | 2025 | | — |

Manjula Talreja(3) | | I | | 64 | | Director | | 2022 | | 2025 | | — |

______________________

(1) Member of our nominating, governance, and corporate governancesustainability committee

(2) Member of our compensation committee

(3) Member of our audit committee

(4) Lead Independent Director

Nominees for Director

Katherine August-deWilde. Ms. August-deWilde has served as a member of our board of directors since January 2016. Ms. August-deWilde is currently the Vice Chair of First Republic Bank (NYSE: FRC), a position she has held since the beginning of 2016, and has served on the board of directors since 1988. First Republic Bank offers private personal banking, private business banking, and private wealth management services. Ms. August-deWilde has held several executive leadership roles at the company, including COO from 1993 to 2014, and President from 2007 to 2015. Previously, Ms. August-deWilde was Senior Vice President and Chief Financial Officer at PMI Group. Ms. August-deWilde currently serves on the board of directors of Eventbrite Inc. (NYSE: EB), a self-service ticketing and registration company, and TriNet Group Inc. (NYSE: TNET), a human resource software solutions company for businesses, as well as a number of privately held companies. She holds a B.A. degree from Goucher College and an M.B.A. from Stanford Graduate School of Business.

| | | | | | | | |

| | Mr. Dach has served as a member of our Board since May 2016. Mr. Dach brings more than 25 years of experience running major business and strategic initiatives across the public, private and civil sectors, including leading corporate affairs and sustainability at Walmart Stores Inc. from 2006 to 2013. Mr. Dach served as senior counselor to the Secretary of the U.S. Department of Health & Human Services from 2014 to 2016. Prior to that, Mr. Dach served as executive vice president of corporate affairs for Walmart and was a member of the company’s executive council and executive finance committee. Mr. Dach has served on numerous boards including the Environmental Defense Fund, World Resources Institute, United Negro College Fund, the Yale University Council and the National Audubon Society. He previously served on our Board from June 2013 to July 2014. Mr. Dach holds a B.S. in Biology from Yale University and an M.P.A. from Harvard University.

Mr. Dach was selected to serve on our Board because of his extensive business experience in both the public and private sector and his prior experience with the Company. |

|

|

|

|

| Leslie Dach |

| Director |

| |

| | | | | | | | |

| | Mr. Fenster, Co-Executive Chair of Sunrun, is one of our co-founders and has served as a member of our Board since the company’s inception. Mr. Fenster was appointed Executive Chairman in March 2014 and previously served as our Chief Executive Officer from June 2008 to October 2012, and as our Co-Chief Executive Officer from October 2012 to March 2014. From May 2003 to June 2005, Mr. Fenster served as Director of Corporate Development at Asurion, LLC, provider of device insurance, warranty and support services for cell phones, consumer electronics and home appliances. From July 1999 to May 2003, Mr. Fenster worked at The Blackstone Group, a private equity firm. Mr. Fenster holds a B.A. in economics from Johns Hopkins University and an M.B.A. from the Stanford Graduate School of Business.

Mr. Fenster was selected to serve on our Board because of the perspective and extensive experience he brings as one of our co-founders and as one of our largest stockholders. |

|

|

|

|

| Edward Fenster |

| Co-Executive Chair & Director |

Ms. August-deWilde was selected to serve on our board of directors because of her extensive executive and risk management experience, as well as her experience in the consumer-facing financial

| | | | | | | | |

| | Ms. Powell has served as our Chief Executive Officer since August 2021 and as a member of our Board since 2018. From 2008 to 2019, Ms. Powell served as the president and chief executive officer of Green Mountain Power Corporation ("GMP"), an electric services company that serves 75 percent of the State of Vermont’s residential and business customers. At GMP, Ms. Powell successfully executed strategies to drive increased customer satisfaction and growth, delivered on an ambitious energy vision to provide low-carbon, low-cost and highly reliable power to Vermonters, and positioned the company as a leading energy transformation business. Ms. Powell's previous roles at GMP include serving as senior vice president and chief operations officer from 2001 to 2008, and as senior vice president of Customer and Organizational Development from 1999 to 2001. Ms. Powell is nationally recognized for her work disrupting the energy sector and has received numerous industry awards, including being named Utility Dive’s 2019 Executive of the Year and one of Fast Company’s 100 Most Creative People in Business in 2016. Prior to joining GMP in 1998, Ms. Powell held executive roles within the banking industry, and served in state government. Ms. Powell currently serves on the board of directors of CGI Inc., a global IT and business consulting services firm, and Energir, the largest gas distributor in Québec and Vermont. From 2019 to 2021, served on the board of Hawaiian Electric Industries Inc., the largest utility in Hawaii. She has also served on the boards of a number of other privately held companies and nonprofits. Ms. Powell also recently chaired the board of Climate Change Crisis Real Impact | Acquisition Corporation, a former special-purpose acquisition corporation that combined with EVgo Services and enabled the fast charging network for electric vehicles to become a publicly listed company. Ms. Powell holds an Associate’s degree from Keene State College.

Ms. Powell was selected to serve on our Board because of her extensive experience and deep knowledge of the energy and utility industry. |

|

|

|

|

| Mary Powell |

| CEO & Director |

| |

Sonita Lontoh. Ms. Lontoh is a nominee for our board of directors. Since April 2018, Ms. Lontoh has served as the Global Head of Marketing of the Personalization, 3D Printing and Digital Manufacturing business of HP Inc., a leading global provider of personal computing, imaging and printing products, and related technologies, solutions and services. Ms. Lontoh previously served as Vice President of Strategic Marketing, Digital Grid NA at Siemens AG, a global technology company focusing on automation, digitalization, intelligent infrastructure, distributed energy systems, and smart mobility solutions, from February 2016 to April 2018. Previously, Ms. Lontoh served as the Director of Marketing of Trilliant, a global provider of industrial IoT solutions enabling smart grid, smart cities, smart lighting, smart metering and distributed energy integration, from February 2011 to February 2016. Earlier in her career, Ms. Lontoh served at PG&E, one of the largest energy utility companies in the United States. Ms. Lontoh currently serves on the board of advisors of the Jacobs Institute for Design Innovation at the University of California, Berkeley. She earned a Bachelor of Science degree in Industrial Engineering and Operations Research from the University of California Berkeley, a Master of Engineering in Logistics from the Massachusetts Institute of Technology (MIT), and an M.B.A. with a focus on strategy and marketing from Northwestern University’s Kellogg School of Management.

Ms. Lontoh was selected to serve on our board of directors because of her extensive experience and knowledge of marketing, the energy industry, customer experiences, and digital transformations.

Gerald Risk. Mr. Risk has served as a member of our board of directors since February 2014. Since March 2013, Mr. Risk has served as Vice Chairman at Asurion, LLC, a provider of device insurance, warranty & support services for cell phones, consumer electronics & home appliances. He previously served in other leadership roles at Asurion, including as its President from May 2009 to March 2013 and its Chief Financial Officer from February 1999 to May 2009, where his responsibilities included oversight of risk management. Mr. Risk currently serves on the boards of directors of a number of privately held companies. Mr. Risk holds a Bachelor of Commerce from Queen’s University and an M.B.A. from the Stanford Graduate School of Business.

Mr. Risk was selected to serve on our board of directors because of his extensive executive and risk management experience, as well as his experience as an operator and investor building emerging growth businesses.

Continuing Directors

Lynn Jurich. Ms. Jurich is one of our co-founders and has served as our Chief Executive Officer since March 2014 and as a member of our board of directors since inception. Ms. Jurich served as our Co-Chief Executive Officer from October 2012 to March 2014, our President from January 2009 to October 2012, and our Executive Vice President of Sales and Marketing from 2007 to January 2009. From July 2002 to July 2005, Ms. Jurich served as an associate at Summit Partners, a private equity firm. Ms. Jurich serves on the board of directors of privately held Generate Capital, Inc. Ms. Jurich holds a B.S. in Science, Technology, and Society from Stanford University and an M.B.A. from the Stanford Graduate School of Business.

Ms. Jurich was selected to serve on our board of directors because of the perspective and experience she brings as one of our co-founders and as one of our largest stockholders.

Alan Ferber. Mr. Ferber has served as a member of our board of directors since February 2018. He served as the Chief Executive Officer of Jackson Hewitt Tax Services, a provider of tax preparation services, from January 2017 until July 2020 and continues to serve as a member of its board of directors. Prior to joining Jackson Hewitt, Mr. Ferber was President of ADT Residential, a home security company, from 2013 until 2016. He also previously held the role of Senior Vice President and Chief Customer Officer for ADT. His other experience includes holding several executive leadership positions at US Cellular, a telecommunications company, from 2001 until 2012 including serving as Executive Vice President and Chief Operating Officer, Chief Strategy and Brand Officer. Mr. Ferber also serves on the board of directors of Alert 360, a privately held alarm-monitoring and security company. Mr. Ferber received a Bachelor of Arts degree in economics from the University of Michigan, and an M.B.A. with a concentration in finance and marketing from Northwestern University’s Kellogg Graduate School of Management.

Mr. Ferber was selected to serve on our board of directors because of his experience and knowledge of consumer-facing industries.

David Bywater. Mr. Bywater has served as a member of our board of directors since October 2020 and as an Advisor since April 2021. He served as the Chief Executive Officer of Vivint Solar, Inc. from December 2016 to April 2021. Mr. Bywater also served as Vivint Solar’s interim President and Chief Executive Officer from May 2016 until his appointment as permanent Chief Executive Officer in December of 2016. Prior to joining Vivint Solar, Mr. Bywater served as the Chief Operating Officer of Vivint, Inc. Prior to that, Mr. Bywater served as Executive Vice President and Corporate Officer for Xerox Corporation, and was the Chief Operating Officer of its State Government Services from 2010 to July 2013. From 2003 to 2010, Mr. Bywater worked at Affiliated Computer Services. From 1999 to 2003, Mr. Bywater was a senior manager at Bain & Company. Mr. Bywater holds a B.S. in economics from Brigham Young University and an M.B.A. from Harvard Business School.

| | | | | | | | |

| | Ms. August-deWilde has served as a member of our Board since January 2016. Ms. August-deWilde is currently the Vice Chair of First Republic Bank, a position she has held since the beginning of 2016, and has served on the board of directors since 1988. First Republic Bank offers private personal banking, private business banking, and private wealth management services. Ms. August-deWilde has held several executive leadership roles at the company, including COO from 1993 to 2014, and President from 2007 to 2015. Previously, Ms. August-deWilde was Senior Vice President and Chief Financial Officer at PMI Group. Ms. August-deWilde currently serves on the board of directors of Eventbrite Inc., a self-service ticketing and registration company, as well as a number of privately held companies. She holds a B.A. from Goucher College and an M.B.A. from Stanford Graduate School of Business.

Ms. August-deWilde was selected to serve on our Board because of her extensive executive and risk management experience, as well as her experience in the consumer-facing financial industry. |

|

|

|

|

| Katherine August-deWilde |

| Director |

| | | | | | | | |

| | Sonita Lontoh has served as a member of our Board since June 2021. From April 2018 to February 2022, Ms. Lontoh served as the Global Head of Marketing (CMO) of the Personalization, 3D Printing and Digital Manufacturing business of HP Inc., a global provider of technology solutions. Ms. Lontoh previously served as Vice President of Strategic Marketing, Digital Grid NA, at Siemens AG, a global leader in automation and digitalization solutions, from February 2016 to April 2018. Prior, Ms. Lontoh served as the Director of Marketing of Trilliant, a global provider of IoT solutions, from February 2011 to February 2016. Earlier in her career, Ms. Lontoh served at PG&E, one of the largest energy utilities in the United States. Ms. Lontoh currently serves on the board of directors of TrueBlue, Inc., a publicly-listed workforce solutions company, and on the board of advisors of the Jacobs Institute for Design Innovation at the University of California, Berkeley. Ms. Lontoh is National Association of Corporate Directors (NACD)-Directorship Certified, Digital Directors Networks’ Cybersecurity-Certified, and has completed the NACD Climate Governance and the Stanford Directors’ College certifications. Ms. Lontoh earned a B.S. degree in Industrial Engineering and Operations Research from the University of California, Berkeley, an M.Eng. in Supply Chain & Logistics from the Massachusetts Institute of Technology (MIT), and an M.B.A. with a focus on strategy and marketing from Northwestern University’s Kellogg School of Management.

Ms. Lontoh was selected to serve on our Board because of her extensive experience and knowledge of the energy industry, digital transformations, marketing, and customer experiences. |

|

|

|

|

| Sonita Lontoh |

| Director |

| |

Mr. Bywater was selected to serve on our board of directors because of his experience leading a residential solar company and his extensive business experience.

Leslie Dach. Mr. Dach | | | | | | | | |

| | Mr. Risk has served as a member of our Board since February 2014. Since March 2013, Mr. Risk has served as Vice Chairman at Asurion, LLC, a provider of device insurance, warranty and support services for cell phones, consumer electronics and home appliances. He previously served in other leadership roles at Asurion, including as its President from May 2009 to March 2013 and its Chief Financial Officer from February 1999 to May 2009, where his responsibilities included oversight of risk management. Mr. Risk currently spends his time as an educator and investor. He is a partner at TTCER Partners, an investment firm. Mr. Risk is also a Lecturer at the Stanford Graduate School of Business and serves on the board of directors of a number of privately held companies. Mr. Risk holds a Bachelor of Commerce from Queen’s University and an M.B.A. from the Stanford Graduate School of Business.

Mr. Risk was selected to serve on our Board because of his extensive executive and risk management experience, as well as his experience as an operator and investor building emerging growth businesses. |

|

|

|

|

| Gerald Risk |

| Director |

| |

| | | | | | | | |

| | Ms. Jurich, Co-Executive Chair of Sunrun, is one of our co-founders and has served as a member of our Board since the company’s inception. Before transitioning to her current role of Co-Executive Chair in August 2021, Ms. Jurich served as Sunrun’s Chief Executive Officer for seven years. Ms. Jurich served as our Co-Chief Executive Officer from October 2012 to March 2014, our President from January 2009 to October 2012, and our Executive Vice President of Sales and Marketing from 2007 to January 2009. From July 2002 to July 2005, Ms. Jurich served as an associate at Summit Partners, a private equity firm. Ms. Jurich serves on the board of directors of privately held Generate Capital, Inc. and the advisory board of Stanford Graduate School of Business. She is also a lecturer at Stanford Graduate School of Business. Ms. Jurich holds a B.S. in Science, Technology, and Society from Stanford University and an M.B.A. from the Stanford Graduate School of Business.

Ms. Jurich was selected to serve on our Board because of the perspective and extensive experience she brings as one of our co-founders and as one of our largest stockholders. |

|

|

|

|

| Lynn Jurich |

| Co-Executive Chair & Director |

| |

| | | | | | | | |

| | Mr. Ferber has served as a member of our Board since February 2018. He served as the Chief Executive Officer of Jackson Hewitt Tax Services, a provider of tax preparation services, from January 2017 until July 2020 and continues to serve as a member of its board of directors. Prior to joining Jackson Hewitt, Mr. Ferber was President-Residential at ADT, the largest home security company, from 2013 until 2016. He also previously held the role of Senior Vice President and Chief Customer Officer for ADT. His other experience includes holding several executive leadership positions at US Cellular, a telecommunications company, from 2001 until 2012 including serving as Executive Vice President and Chief Operating Officer, Chief Strategy and Brand Officer. Mr. Ferber received a B.A. in economics from the University of Michigan, and an M.B.A. with a concentration in finance and marketing from Northwestern University’s Kellogg Graduate School of Management.

Mr. Ferber was selected to serve on our Board because of his extensive experience and knowledge of consumer-facing industries. |

|

|

|

|

| Alan Ferber |

| Director |

| |

| | | | | | | | |

| | Ms. Talreja has served as a member of our Board since January 2022. Ms. Talreja is currently the Senior Vice President and Chief Customer Officer of PagerDuty, Inc., a cloud computing company specializing in a SaaS (Software-as-a-service) incident response platform. From March 2016 until June 2020, Ms. Talreja served as Senior Vice President of the Customer Success Group at Salesforce.com, Inc., a customer relationship management SaaS platform company. Ms. Talreja served in several senior leadership roles from 1993 to 2015 at Cisco Systems, Inc., a networking, cloud, and security solutions provider, including Vice President, Sales-Cisco Partnerships, and Vice President of Cisco Consulting Services. Ms. Talreja has been recognized as an industry leader, including being named one of the “2020 Top 50 Women in Technology” by the National Diversity Council. She holds a B.S. in Information Technology from Santa Clara University, and a B.S. in Economics from Delhi University, India.

Ms. Talreja was selected to serve on our Board because of her extensive customer experience and operations knowledge and business experience. |

|

|

|

|

| Manjula Talreja |

| Director |

| |

Executive Officers

The following table identifies certain information about our executive officers as of April 6, 2023. Our executive officers are appointed by, and serve at the discretion of, our boardBoard. There are no family relationships among any of our directors since May 2016.or executive officers.

| | | | | | | | | | | | | | |

Name(1) | | Age | | Position |

| Mary Powell | | 62 | | Chief Executive Officer and Director |

| Danny Abajian | | 38 | | Chief Financial Officer |

| Paul Dickson | | 37 | | Chief Revenue Officer |

| Jeanna Steele | | 48 | | Chief Legal Officer and Chief People Officer |

______________________

(1) See “Nominees for Director” above for biography of Ms. Powell. Mr. Dach brings more than 25 years of experience running major business and strategic initiatives across the public, private and civil sectors, including leading corporate affairs and sustainability at Walmart Stores Inc. from 2006Fenster ceased to 2013. Mr. Dach served as senior counselor to the Secretarybe an executive officer of the U.S. DepartmentCompany, pursuant to Item 501(f) of Health & Human Services from 2014 to 2016. Prior to that, Mr. Dach servedRegulation S-K under Securities Exchange Act of 1934, as executive vice presidentamended (the “Exchange Act”), effective March 1, 2023.

| | | | | | | | |

| | Mr. Abajian has served as our Chief Financial Officer since May 2022. Prior to becoming our Chief Financial Officer, Mr. Abajian served in many leadership roles within our Project Finance organization, including Senior Vice President from April 2020 to June 2022, Vice President from February 2016 to April 2020, Senior Director from August 2013 to February 2016, and Director from July 2010 to August 2013. From July 2005 to July 2010, Mr. Abajian was an investment banker, having served as an associate at Barclays Capital and an analyst and associate at BNP Paribas. Mr. Abajian holds a B.S. in finance and international business from the New York University Stern School of Business. |

|

|

|

|

| Danny Abajian |

| Chief Financial Officer |

Mr. Dach was selected to serve on our board of directors because of his extensive business experience in both the public and private sector and his prior experience with the Company.

Edward Fenster. Mr. Fenster is one of our co-founders and has served as our Executive Chairman since March 2014 and as a member of our board of directors since inception. Mr. Fenster served as our Chief Executive Officer from June 2008 to October 2012, and our Co-Chief Executive Officer from October 2012 to March 2014. From May 2003 to June 2005, Mr. Fenster served as Director of Corporate Development at Asurion, LLC, provider of device insurance, warranty & support services for cell phones, consumer electronics & home appliances. From July 1999 to May 2003, Mr. Fenster worked at The Blackstone Group, a private equity firm. Mr. Fenster holds a B.A. in economics from Johns Hopkins University and an M.B.A. from the Stanford Graduate School of Business. | | | | | | | | |

| | Mr. Dickson has served as our Chief Revenue Officer since January 2022, prior to that, he served as Senior Vice President. Mr. Dickson served as Chief Revenue Officer at Vivint Solar, Inc. from September 2016 until he joined us in October 2020 via our acquisition of Vivint Solar, Inc. Prior to his role as Chief Revenue Officer he served as Vivint Solar, Inc.’s Senior Vice President of Operations from November 2013 to September 2016, and as Vivint Solar, Inc.’s Vice President of Finance and Capital Markets from May 2011 to November 2013. Prior to joining Vivint Solar, Inc.’s founding team, Mr. Dickson served as the Director of Smart Grid and Energy Management for Vivint, Inc. from December 2010 to May 2011. From May 2007 to December 2010, Mr. Dickson co-founded and served as the President and Chief Executive Officer of Meter Solutions Pros, LLC, an energy management and smart-grid business acquired by Vivint, Inc. Mr. Dickson holds a B.A. in communications from Brigham Young University. |

|

|

|

|

| Paul Dickson |

| Chief Revenue Officer |

| |

Mr. Fenster was selected to serve on our board of directors because of the perspective and experience he brings as one of our co-founders and as one of our largest stockholders.

Mary Powell. Ms. Powell has served as a member of our board of directors since February 2018. She served as the President and Chief Executive Officer of Green Mountain Power Corporation, an electric services company that serves 75% of the State of Vermont’s residential and business customers, from 2008 to 2019. Her previous roles at Green Mountain Power Corporation included Senior Vice President and Chief Operations Officer from 2001 to 2008, and Senior Vice President, Customer and Organizational Development from 1999 to 2001. Ms. Powell has been nationally recognized for her work transforming the energy system by outlets including Fast Company magazine and has received numerous industry awards, most recently being named Utility Dive’s 2019 “Executive of the Year” in recognition for her leadership of Vermont’s investor-owned utility to prioritize and deliver on customer-choice distributed energy solutions. Ms. Powell currently serves on the board of directors of Hawaiian Electric Industries Inc. (NYSE: HE), the largest utility in Hawaii, CGI Inc. (NYSE:GIB), a global IT and business consulting services firm, and Climate Change Crisis Real Impact I Acquisition Corporation (NYSE: CLII), a special-purpose acquisition corporation. She also serves on the boards of a number of other privately held companies and nonprofits. Ms. Powell holds an Associate’s degree from Keene State College. | | | | | | | | |

| | Ms. Steele has served as our Chief Legal Officer since May 2018 and our Chief People Officer since December 2021 where she oversees legal affairs, people strategy, operations and development, health & safety, and environmental, social, governance (ESG) matters. From March 2015 to May 2018, Ms. Steele served in various roles at our company, including Head of Litigation. Previously, Ms. Steele was an attorney at the law firm Wilson Sonsini Goodrich & Rosati. Ms. Steele serves on the board of directors of the Giffords Law Center to Prevent Gun Violence, and she is a former member of the California Pay Equity Task Force, the first of its kind in the nation. Ms. Steele holds a B.A. in English from McGill University and a J.D. from the University of San Francisco. |

|

|

|

|

| Jeanna Steele |

| Chief Legal Officer & Chief People Officer |

Ms. Powell was selected to serve on our board of directors because of her extensive experience and knowledge of the energy and utility industry.

Director Independence

Our common stock is listed on Nasdaq. UnderNasdaq, and under the listing standards of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors, as affirmatively determined by the board of directors.Board. In addition, the Nasdaq listing standards require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating, governance, and corporate governancesustainability committees be independent. Under the Nasdaq listing standards, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors,Board, that director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act, of 1934, as amended (the “Exchange Act”), and the Nasdaq listing standards. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the Nasdaq.

Our board of directorsBoard has undertaken a review of the independence of each of our directors and our director nominee.directors. Based on information provided by each director and director nominee concerning his or her background, employment and affiliations, our board of directorsBoard has determined that directors Katherine August-deWilde, LeslieMs. August de-Wilde, Mr. Dach, AlanMr. Ferber, Mary Powell, Ellen Smith, and GeraldMs. Lontoh, Mr. Risk, and director nominee Sonita Lontoh,Ms. Talreja, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors or director nominee is “independent” as that term is defined under the Nasdaq listing standards. In making these determinations, our board of directorsBoard considered the current and prior relationships that each non-employee director and director nominee has with the Company and all other facts and circumstances our board of directorsBoard deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director and director nominee.director.

Board Leadership Structure and Lead Independent Director

Our Corporate Governance Guidelines require that if we do not have an independent chairperson then we will appoint a lead independent director. Mr. Fenster and Ms. Jurich currently servesserve as an executiveCo-Executive Chairs and Executive Chairmandirectors of our board of directors.the Company. Our board of directorsBoard believes that it can benefit from each of Mr. Fenster’s and Ms. Jurich’s years of experience as a founderfounders and executiveexecutives of the Company. Mr. Fenster possessesand Ms. Jurich each possess detailed in-depth knowledge of the issues, opportunities, and challenges facing us.the Company and the broader solar industry.

Our board of directorsBoard appointed Mr. Risk as the Lead Independent Director of our board of directorsBoard on June 7, 2019. Our board of directorsBoard believes that the current boardBoard leadership structure, with a strong emphasis on boardBoard independence, allows our management team to focus on our day-to-day business while allowing the Lead Independent Director to lead our board of directorsBoard in its fundamental role of providing independent advice to and oversight of management. In addition, as described below, our boardBoard has three standing committees, each member of which is an independent director. Our boardBoard delegates substantial responsibility to each committee of the board,Board, which reports their activities and actions back to the full board.Board. We believe that the independent committees of our boardBoard are an important aspect of the leadership structure of our board.Board.

Board Meetings and Committees

During our fiscal year ended December 31, 2020,2022, our board of directorsBoard held tenfive meetings (including regularly scheduled and special meetings). During fiscal year 2020,2022, each of our directors attended at least 75% of the meetings of the Board and committees on which he or she served as a member.

Although we do not have a formal policy regarding attendance by members of our board of directorsBoard at annual meetings of stockholders, we strongly encourage our directors to attend. All then-serving members of our board of directorsBoard attended our 20202022 annual meeting of stockholders.

Our board of directorsBoard has established an audit committee, a compensation committee and a nominating, governance, and corporate governancesustainability committee. The composition and responsibilities of each of the three committees of our board of directorsBoard is described below. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.Board.

Audit Committee

Our audit committee currently consists of Mr.Messrs. Risk Ms. Powell and Mr. Dach and Mses. Lontoh and Talreja, with Mr. Risk serving as the chair. Each member of our audit committee meets the requirements for independence and financial literacy for audit committee members under the Nasdaq listing standards and SEC rules and regulations. In addition, our board of directorsBoard has determined that Mr. Risk is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”).Exchange Act. Our audit committee is responsible for, among other things:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•helping to ensure the independence and performance of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations;

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•evaluating the performance of our internal audit function;

•reviewing our policies on risk assessment and risk management;management pertaining to the financial, accounting, tax, cybersecurity and information technology matters of the Company;

•reviewing and discussing with management, and reporting to the full Board and assisting the Board in the oversight and assessment of risks relating to significant cybersecurity matters and concerns involving the Company, including information security, data privacy, backup of information systems, and related party transactions;regulatory matters and compliance;

•reviewing and overseeing related party transactions and developing policies and procedures for the audit committee’s review, approval and/or ratification of such transactions; and

•approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the Nasdaq listing standards. A copy of the charter of our audit committee is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. During our fiscal year ended December 31, 2020,2022, our audit committee held five meetings.

Compensation Committee

Our compensation committee currently consists of Mses. August-deWilde and PowellLontoh and Mr. Ferber, with Ms. August-deWilde serving as the chair.

Each member of our compensation committee meets the requirements for independence for compensation committee members under the Nasdaq listing standards and SEC rules and regulations, including Rule 10C-1 under the Exchange Act. Each member of our compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code (the “Code”). Our compensation committee is responsible for, among other things:

•reviewing, approving and determining, or making recommendations to our board of directorsBoard regarding, the compensation of our executive officers;

•administering our equity compensation plans;

•reviewing, approving and making recommendations to our board of directorsBoard regarding incentive compensation and equity compensation plans;

•evaluating director compensation and making recommendations to our board of directorsBoard regarding the compensation of our directors; and

•establishing and reviewing general policies relating to compensation and benefits of our employees.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the Nasdaq listing standards. A copy of the charter of our compensation committee is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. During our fiscal year ended December 31, 2020,2022, our compensation committee held sixfive meetings.

Nominating

Our nominating, governance, and Corporate Governance Committee

Oursustainability committee, formerly our nominating and corporate governance committee, consists of Ms. August-deWilde and Messrs. Ferber and Dach, with Mr. Dach serving as the chair.

Each member of our nominating, governance, and corporate governancesustainability committee meets the requirements for independence under the Nasdaq listing standards and SEC rules and regulations. Our nominating, governance, and corporate governancesustainability committee is responsible for, among other things:

•identifying, evaluating and selecting, or making recommendations to our board of directorsBoard regarding, nominees for election to our board of directorsBoard and its committees;

•evaluating the performance of our board of directorsBoard and of individual directors;

•considering and making recommendations to our board of directorsBoard regarding the composition of our board of directorsBoard and its committees;

•reviewing developments in corporate governance practices;

•evaluating the adequacy of our corporate governance practices and reporting;

•developing and making recommendations to our board of directorsBoard regarding corporate governance guidelines and matters; and

•reviewing our strategies, activities, policies, and communications regarding environmental, social and governance (“ESG”) related matters.

matters and receive updates from the Company’s management committee responsible for significant ESG and sustainability activities.Our nominating, governance, and corporate governancesustainability committee operates under a written charter that satisfies the applicable Nasdaq listing standards. A copy of the charter of our nominating, governance, and corporate governancesustainability committee is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investor Relations – Leadership & Governance” section. During our fiscal year ended December 31, 2020,2022, our nominating, governance, and corporate governancesustainability committee held fourthree meetings.

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, Mses. August-deWilde and PowellLontoh and Mr. Ferber served as members of our compensation committee. None of the members of our compensation committee is or has beenwas an officer or employee of our company.company at the time of his or her service on the compensation committee or prior to such service. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our board of directorsBoard or compensation committee.

Considerations in Evaluating Director Nominees

Our nominating, governance, and corporate governancesustainability committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our nominating, governance, and corporate governancesustainability committee will consider the current size and composition of our board of directorsBoard and the needs of our board of directorsBoard and the respective committees of our board of directors.Board. Some of the other qualifications that our nominating, governance, and corporate governancesustainability committee considers include, without limitation, issues of character, integrity, judgment, diversity, independence, areaareas of expertise, corporate experience, length of service, potential conflicts of interest, and other commitments. Nominees must also have the ability to offer advice and guidance to our Chief Executive Officer based on past experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Director candidates must have sufficient time available in the judgment of our nominating, governance, and corporate governancesustainability committee to perform all board of director and committee responsibilities. Members of our board of directorsBoard are expected to prepare for, attend, and participate in all board of director and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating, governance, and corporate governancesustainability committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

Although our board of directorsBoard does not maintain a specific policy with respect to board diversity, our board of directorsBoard believes that our board of directorsBoard should be a diverse body, and our nominating, governance, and corporate governancesustainability committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors,The nominating, governance, and sustainability committee is committed to diversity on our nominatingBoard and corporate governance committee may taketakes into account the benefitspersonal characteristics, skills, expertise, and experience of diverse viewpoints.current and prospective directors, such as ethnicity, gender, race, and membership in another underrepresented community, to ensure the representation of a variety and range of perspectives on our Board and encourage effective performance of its governance role and oversight of our the execution of our strategy. Our nominating, governance, and corporate governancesustainability committee also considers these and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, our nominating, governance, and corporate governancesustainability committee recommends to our full board of directorsBoard the director nominees for selection.

With the election

Diversity of the Class III directorBoard of Directors

We believe our Board should consist of individuals reflecting the diversity represented by our employees, customers, and communities in which we operate. The below table provides information related to the composition of our nine board members and nominees Sunrun's board will be in compliance with the requirements of California Assembly Bill No. 979 that become effective as of December 31, 2021.April 6, 2023. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Number of Directors | | 9 |

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | | 5 | | 4 | | — | | — |

| Part II: Demographic Background |

| African American or Black | | — | | — | | — | | — |

| Alaskan Native or Native American | | — | | — | | — | | — |

| Asian | | 2 | | — | | — | | — |

| Hispanic or Latinx | | — | | — | | — | | — |

| Native Hawaiian or Pacific Islander | | — | | — | | — | | — |

| White | | 3 | | 4 | | — | | — |

| Two or More Races or Ethnicities | | — | | — | | — | | — |

| LGBTQ+ | | — | | — | | — | | — |

| Did Not Disclose Demographic Background | | — | | — | | — | | — |

Our Board from left to right: Alan Ferber, Manjula Talreja, Sonita Lontoh, Edward Fenster, Mary Powell, Lynn Jurich, Gerald Risk, Katherine August-deWilde, and Leslie Dach.

Skills, Attributes, and Experience of the Board of Directors

The skills, attributes, and experience matrix below summarizes some of the key qualifications, experiences, attributes, and skills that each of our members of the Board brings to the Board to enable effective oversight and performance. This matrix is intended to provide a summary of each of their qualifications and is not a complete list of each director's contributions or strengths to the Board. Additional details on the qualifications, experiences, attributes, and skills of each member of our Board are set forth in their biographies above.

Director Continuing Education

We provide our members of the Board with continuing education and presentations developed by both internal and external expert speakers. These opportunities are designed to enhance and expand on the key skills and experiences applicable to serving on public company boards of directors, educate them about the landscape, relevant issues, and ongoing developments relevant to our industry, and keep them apprised of evolving and dynamic topics relevant to their service on our Board, such as cyber- and information-security, governance trends, ESG trends, and updates to applicable regulations and policies. In addition, the Board and its committees engaged in deep-dive sessions and/or table-top exercises on various topics presented by management, our external advisors, and applicable third-party experts and consultants.

Evaluations of the Board of Directors

Our Board, the committees of our Board, and each individual director conducts an annual self-assessment of their performance. This process is overseen by the nominating, governance, and sustainability committee.

The self-evaluation process involves the following:

•Each director completes a written self-assessment consisting of individual performance questions as a member of the Board and the committees of our Board, and the Board as a whole, and provides feedback on such matters.

•The completed written self-assessments are reviewed by the chair of the nominating, governance, and sustainability committee.

•Upon completion of the nominating, governance, and sustainability committee chair's review of the written self-assessments, the chair meets with each director individually to discuss their self-assessment and other feedback, including but not limited to, the Board and its committees effectiveness and composition, organization of meetings, materials and communications, adequacy of internal and external support to the Board and its committees, and any other observations arising from the self-assessment process.

•The results of these self-evaluations and any related recommendations are summarized by the nominating, governance, and sustainability committee chair.

•The Board reviews and discusses the findings and recommendations resulting from the process.

•Valuable and meaningful feedback is generated as a result of the self-assessment process and it is thoughtfully considered and incorporated by the Company.

Stockholder Recommendations for Nominations to the Board of Directors

Our nominating, governance, and corporate governancesustainability committee will consider candidates for director recommended by stockholders holding at least one percent (1%) of the fully diluted capitalization of our company continuously for at least twelve (12) months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporationRestated Certificate and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC.Our nominating, governance, and corporate governancesustainability committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above.This process is designed to ensure that our board of directorsBoard includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business.Eligible stockholders wishing to recommend a candidate for nomination should contact our General CounselChief Legal Officer or our Legal Department in writing.Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Board.Our nominating, governance, and corporate governancesustainability committee has discretion to decide which individuals to recommend for nomination as directors.

The Board values our stockholders’ perspectives, and feedback from our stockholders has been important considerations for discussions with the Board and its committees throughout the year. In response to investor feedback during the past few years, we have made a number of enhancements to our governance and compensation practices and disclosures, including the introduction of performance equity and stock ownership guidelines, adoption of a clawback policy, and more robust ESG disclosures.

Any nomination must comply with the requirements set forth in our bylaws and should be sent in writing to our Corporate Secretary at Sunrun Inc., 225 Bush Street, Suite 1400, San Francisco, CA 94104. To be timely for our 20222024 annual meeting of stockholders, our Corporate Secretary must receive the nomination no earlier than February 5, 20224, 2024 and no later than March 7, 2022.

Communications with the Board of Directors

Interested parties wishing to communicate with our board of directorsBoard or with individual members of our board of directorsBoard may do so by writing to our board of directorsBoard or to the particular members of our board of directors,Board, and mailing the correspondence to our General CounselChief Legal Officer at Sunrun Inc., 225 Bush Street, Suite 1400, San Francisco, CA 94104. Our General Counsel,Chief Legal Officer, in consultation with appropriate members of our board of directorsBoard as necessary, will review all incoming communications and, if appropriate, such communications will be forwarded to the appropriate member or members of our board of directors,Board, or if none is specified, to the Chairmanchairs of our boardBoard.

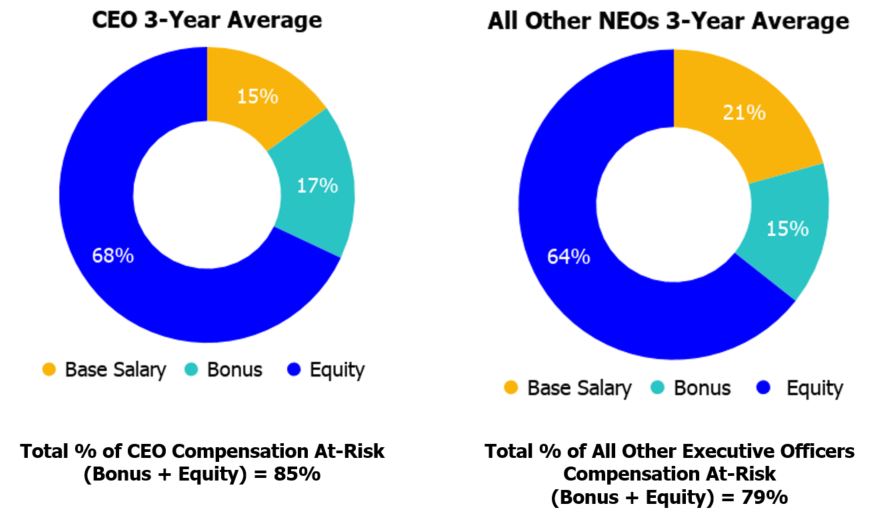

ESG (Environmental, Social and Governance)